Loading...

Loading...

Treasury Analyst

- Orillia, Ontario

The City of Orillia is hiring a

Treasury Analyst

The City of Orillia is less than 90 minutes from the Greater Toronto Area. Even though growth and progress have been strong in recent years,

the Sunshine City has worked hard to retain the small-town charm that has captivated generations. The quality of life is unbeatable in this city

surrounded by two lakes, where outdoor pursuits are available in all seasons and are enjoyed by both visitors and residents.

The City does not use artificial intelligence in the hiring process. All job applications are reviewed personally by the appropriate Department/Division.

This position is a new position created through the budget process and is currently vacant.

The City of Orillia is currently seeking a highly motivated individual to fill the position of Treasury Analyst.

Reporting to the Supervisor of Financial Accounting and Audit, this position provides analytical and operational support in the preparation and

ongoing monitoring of monthly bank, investment, reserve, subledger and general ledger reconciliations, journal entry preparation, and investment

tracking and analysis. The role supports timely month-end and year-end close activities, audit readiness, and compliance reporting by preparing

supporting schedules, analyses, and working papers, while contributing to the stabilization and consolidation of core treasury activities.

Candidates must have a Post-Secondary Diploma in Business Administration, Accounting or Finance with a minimum years of relevant financial

reporting and reconciliation experience, preferably in a public sector organization. A Chartered Professional Accountant (CPA) Designation and

member in good standing is an asset.

The City of Orillia offers a competitive salary, a comprehensive benefits package, and registration with the OMERS pension plan.

The salary for this position is $70,130 to $75,852 (2026 rates) based on a 35-hour work week.

Interested candidates with the required qualifications are welcome to submit their resume and letter of interest by January 9, 2026, at noon.

Applications will only be accepted by applying online. Please click the “Apply Now” button below.

We thank all applicants, however, only those selected for an interview will be contacted.

Note: The City of Orillia is committed to an inclusive, barrier-free environment. Accommodation will be provided in all steps of the hiring process. Please advise the City of Orillia

Human Resources Department if you require any accommodations to ensure you can participate fully and equally during the recruitment and selection process.

We thank all applicants that apply and advise that only those to be interviewed will be contacted. In accordance with the Municipal Freedom of nformation and Protection of Privacy Act,

personal information is collected under the authority of the Municipal Act 2001,S.O. 2001, c. 25., and will be used for the purpose of candidate selection. Questions about this collection should

be directed to the Freedom of Information Coordinator, City of Orillia, 50 Andrew St. S., Orillia ON L3V 7T5.

Treasury Analyst

![]() Position Synopsis and Purpose

Position Synopsis and Purpose

The Treasury Analyst position provides treasury processing, analytical, and operational support to promote the accuracy, timeliness, and

sustainability of the City’s financial operations.Reporting to the Supervisor of Financial Accounting and Audit, this role supports core treasury

functions including accounts payable and accounts receivable overflow, bank and account reconciliations, fixed assets and tangible capital

asset tracking,investment monitoring, grant reporting, journal entries, and internal control documentation and reviews.

This position strengthens financial stewardship, reporting, and decision support by assisting with year-end closing, financial statements

preparation, audit readiness and completion, and Financial Information Return reporting, while enhancing operational continuity and capacity

within the Treasury team.

![]() Major Responsibilities

Major Responsibilities

|

Description |

Approx. Time Spent (%) |

|

Treasury Operations and Accounting

|

50% |

|

Finacal Reporting, Analysis and Grants

|

25% |

|

Audit Controls and Compliance

|

15% |

|

Administration

|

10% |

*Note: All activities are expected to be performed in a safe manner, in accordance with the Occupational Health and Safety Act and its Regulations, along with Corporate Safety policies, procedures and programs. In addition, all necessary personal protective equipment must be used and maintained in good condition.

![]() Decision Making and Independence

Decision Making and Independence

1. Examples of the types of decisions that are made or issues/situations that are dealt with on a regular basis and how judgement is used to resolve them.

- Exercise judgment when preparing and reviewing account and bank reconciliations to ensure accuracy, completeness, and appropriate resolution of variances, escalating complex or unusual variances to the Supervisor.

- Apply appropriate accounting treatment for routine journal entries and transactions, consulting or escalating complex or unusual items as needed.

- Prioritize competing deadlines during peak periods (e.g., year-end, audit, grant reporting) to support timely and accurate financial reporting under Supervisor guidance.

- Identify potential process or workflow improvements and recommend solutions for Supervisor consideration.

2. Examples of situations or problems that are referred to the supervisor for direction or resolution.

- Significant reconciliation discrepancies or unresolved variances.

- Unusual or complex accounting transactions or interpretation of accounting standards.

- Proposed changes to treasury processes, workflows or system functionality that may impact controls or reporting.

- Internal control exposures or procedural gaps identified during routine work that may affect accuracy, compliance, or audit outcomes.

- Staffing or operational issues that could affect accuracy, timeliness, or continuity of financial operations.

![]() Minimum Qualifications

Minimum Qualifications

Education (degree/diploma/certifications)

- Post-Secondary Diploma in Business Administration, Accounting or Finance.

- Progress towards a Chartered Professional Accountant (CPA) designation is considered an asset.

Experience

-

Minimum of three years of relevant financial reporting and budgeting experience, preferably in a public-sector organization.

Knowledge/Skills/Ability

- Possess thorough knowledge of accounting principles.

- Excellent analytical skills with the ability to interpret financial information.

- Strong attention to detail to ensure accurate and reliable information.

- Excellent interpersonal, verbal and written communication skills, together with strong organizational, time management and multitasking.

- Excellent computer skills using MS Office Suite, including Outlook, Excel, Word, Power BI, together with other application software such as Microsoft Dynamics Great Plains.

Physical Demands

- Work is conducted in a standard office environment with periods of sitting, standing or walking.

- The role requires high attention to detail, continual visual concentration and multitasking across multiple priorities and hard deadlines

Position Requirements

- Possess a valid class ‘G’ Ontario’s driver’s licence and access to a reliable vehicle.

- A current and acceptable Criminal Record Check is required prior to the employment commencement date.

- Attendance at meetings, seminars and conferences as required. Attendance at meetings after hours may be required.

- Must have a high-speed internet connection and a proper workstation at a home location.

![]() Position Classification

Position Classification

|

Position Title: Treasury Analyst |

Division: Financial Services |

|

Department: Corporate Services |

Classification: Exempt (non-union) |

|

Work Location: Orillia City Centre |

Reports to (Direct): Supervisor of Financial Accounting and Audit |

|

Position(s) Supervised Directly: None |

Position(s) Supervised Indirectly: None |

|

Effective Date: |

Revision Date: December 18, 2025 |

|

Salary Range: Category 3 - Exempt Salary Schedule |

Hours per Week: 35 |

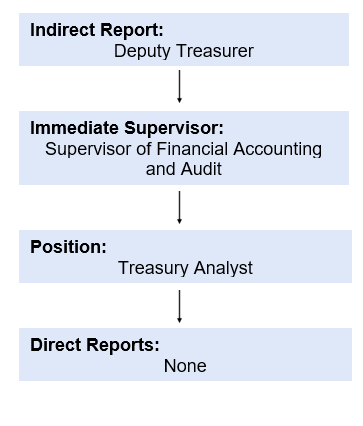

![]() Organizational Chart

Organizational Chart

Below is the reporting relationship of this position to others within the immediate department.